Making a Planned Gift

Making a legacy gift to Access Fund helps to ensure that the vitality and tradition of climbing live on—and that our treasured climbing areas remain protected for the next generation. Some of us may never develop a climbing route, put up a first ascent, write a guidebook, or climb 5.15. But there are other ways to contribute to the story of climbing in America. Planning a deferred gift to Access Fund is an easy way to establish your own legacy of climbing access, and give back to the climbing experience. Planned giving is not just for the wealthy or those with expertise in financial planning. Rather, it can be a very simple way to leave behind a gift of any value to support the work and mission of Access Fund.

We invite you to read through the various ways you can leave assets, retirement income, or a portion of your estate to Access Fund:

Bequests

Life Insurance or Retirement Plan

Charitable Trusts and Annuities

Other Planned Gifts

An Example of a Planned Gift

Let's Connect

We are ready to help you identify and craft a plan to ensure that your legacy gift is invested in Access Fund’s mission, according to your personal and philanthropic goals. Please contact us for more information on planning a deferred gift to Access Fund.

[PHOTO CREDIT] Sierras, © Jerry Dodrill

Learn about the various ways you can leave assets, retirement income, or a portion of your estate to Access Fund. If you have any questions or are ready to get started, please get in touch. We're here to help!

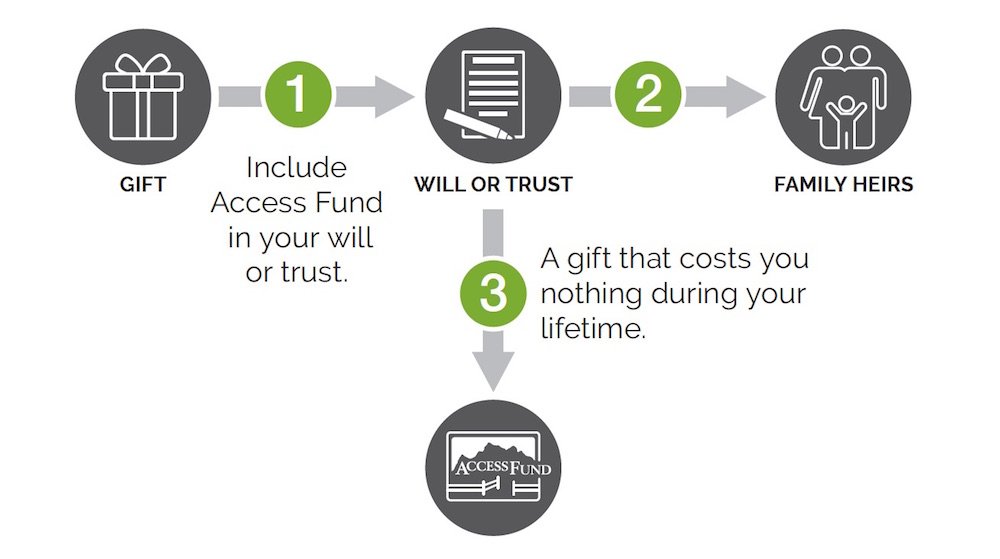

BEQUESTS

Consider leaving assets to Access Fund in your will or estate plan. This is the easiest way to leave a legacy gift and provide crucial funds to help Access Fund protect and conserve climbing areas for years to come.

How It Works

Name Access Fund in your will or estate planning documents.

Access Fund can be named for a specific amount, a percentage of your estate, or a specific remainder of your estate after all other bequests to friends and loved ones are taken care of.

Here is some sample language that can be used to provide a bequest: “I give, devise, and bequeath to Access Fund, a nonprofit organization located in Boulder, Colorado, with the tax identification number 94-3131165, (the sum of $____________)/ (the following property ____________)/ (or ____________ percent of my estate) as an unrestricted gift to be used at the discretion of the Board of Directors of Access Fund for the general purposes of Access Fund.”

Life Insurance or Retirement Plan

You can create a legacy, while providing ongoing support for Access Fund’s work, by naming Access Fund as a beneficiary or your life insurance, retirement plan, or annuity.

How It Works

Name Access Fund as a beneficiary of your insurance policy, retirement plan (a particularly wise gift for tax purposes), or annuity. Access Fund can help you and your advisors with this process. For sample language, see the Bequests section of this brochure.

Access Fund uses your donated assets to fulfill your intent, whether to provide funds for general operations and programs, or to support a specific area of Access Fund’s programs (e.g. land acquisitions, policy work, or conservation and stewardship).

Charitable Trusts and Annuities

You can establish gifts that provide Access Fund with investment income now, and after a specified period of time, you can either return assets to your heirs or pass those assets to Access Fund in the form of a legacy gift. This type of gift can be a powerful income and estate planning tool that helps you achieve multiple financial and charitable goals.

How It Works

Create a trust according to your unique needs and wishes by working with Access Fund’s development team and your own advisors.

Receive tax benefits.

Depending on the type of trust you choose, income from the trust is directed to you or donated to Access Fund.

Other Planned Gifts

You can easily make a gift of real estate, business interests, or other assets to Access Fund. A tangible asset such as a house, art, or a vehicle can be donated to Access Fund in your will. There are often tax advantages to doing so. Contact us to find an option that is the right fit for you.

How It Works

Name Access Fund as the beneficiary of a specific tangible item or portion of your estate in your will or estate planning documents. You may avoid costly gift and estate taxes.

You can specify certain conditions that must be met before an asset or share of your estate is transferred; for example: “If my wife, [Susan], is not living at the time of my death, I give her share of my estate to Access Fund, a nonprofit organization in Boulder, Colorado.”

Your gift will be liquidated and used by Access Fund to honor your wishes.

Jennifer's Story: Example of an Access Fund Legacy Gift

Jennifer loves climbing and is a longtime member of Access Fund. She is 50 years old and has two children. Her estate contains personal possessions, an insurance policy, and a sizable retirement account. Upon her death, Jennifer wants to provide for her children, but also wants to give back to the sport of climbing by making a donation to Access Fund.

To achieve both goals and minimize her tax obligations, Jennifer decides to name Access Fund as a beneficiary of a portion of her retirement account, since those funds would pass to Access Fund free of any income tax obligation. Jennifer’s children will benefit from the remainder, as well as any other assets in her estate that are free of income taxes. Access Fund will be able to use Jennifer’s legacy gift to protect and conserve climbing areas for years to come.

Access Fund Legacy Society

Over more than a quarter-century, Access Fund has built a legacy of protecting climbing areas in America. Let us help you add your legacy to this story.

If you’ve included Access Fund in your estate plans—at any amount—please let us know. We’d like to acknowledge your commitment through our Access Fund Legacy Society. Its purpose is to thank you and pay tribute to those who give with an eye to the future. We also honor anonymous gifts.

Let's Connect

We are ready to help you identify and craft a plan to ensure that your legacy gift is invested in Access Fund’s mission, according to your personal and philanthropic goals. Please contact us for more information on planning a deferred gift to Access Fund.

303-545-6772

philanthropy@accessfund.org

Access Fund

Attn: Director of Philanthropy

P.O. Box 17010

Boulder, Colorado 80308